Are you thinking about putting away some money for a rainy day and wondering what the best savings app in Nigeria is?

Whether you’re saving toward unforeseen emergencies, to finance a big goal like your wedding, or simply towards a future investment, keeping aside some money is essential.

One way to save money would be to keep it in a bank. However, with fintech companies and savings apps like Bold generally offering far higher interest rates than traditional banks, saving with banks wouldn’t be the best move.

Instead, if you’d like to get the best value for your savings, you should take a look at the different savings apps and fintech apps out there to find one that offers great rates.

In this article, we’ve done that for you, and we’ll be highlighting what we strongly feel is the best savings app in Nigeria. But first, we’ll walk you through a few of the most important factors to consider when choosing the best savings app.

What Factors Should You Consider in Choosing the Best Savings App?

As we’ve mentioned, there are numerous savings apps to choose from in Nigeria. With so many out there, you’ll need to be careful which one you choose, as not all offer the same benefits.

Here are the factors we’d recommend that you focus on:

- Interest Rates:

Interest rates vary from company to company. Needless to say, however, you should be keeping your money with savings apps that offer the best interest rates. At Bold, for example, users can currently lock in their funds at interest rates as high as 15% per annum.

- Fees

Some apps require that users maintain a certain minimum balance, or may charge some extra fees for using their platforms. If you’re looking to save and keep as much of your money as possible, it makes sense to look for apps that charge minimal fees or no fees at all. With so many options to consider, you should only go for the best deal.

- Accessibility:

How easy does a savings app make it for you to withdraw your funds? Ideally, you should be able to withdraw directly into a designated account. Some savings apps, like Bold, will even allow you to do other things like convert your money into other currencies or fund a virtual card for online shopping.

- Security

Unfortunately, there are numerous financial scams and suspicious savings apps out there. To avoid falling victim to these, you should only choose a savings app that offers the highest degree of security.

This means, firstly, that the savings app you choose should be legitimate and licensed by the Central Bank of Nigeria. Secondly, you will want to ensure that the company also deploys robust security features to keep hackers at bay.

- Customer Service and Reputation

One easy way to tell how proactive the customer care team of any savings app is would be to send them a message before you sign up, asking them a basic question about the app. Strong customer care teams will respond promptly and helpfully, and you can expect this to continue in future encounters.

The Top Savings Apps in Nigeria

What are some of the top savings apps in Nigeria? Here are the top 10 to consider:

- Bold

- PiggyVest

- CowryWise

- ALAT by Wema

- Kuda Bank

- Carbon

- Branch

- Renmoney

- FairMoney

- Risevest

Which is the Best Savings App in Nigeria?

We’ve shared a list of what we consider to be the top 10 savings apps to consider using in Nigeria. We’ve also shared a few tips on how to choose the best savings app. Now we’ll share what we consider to be the best savings app in Nigeria.

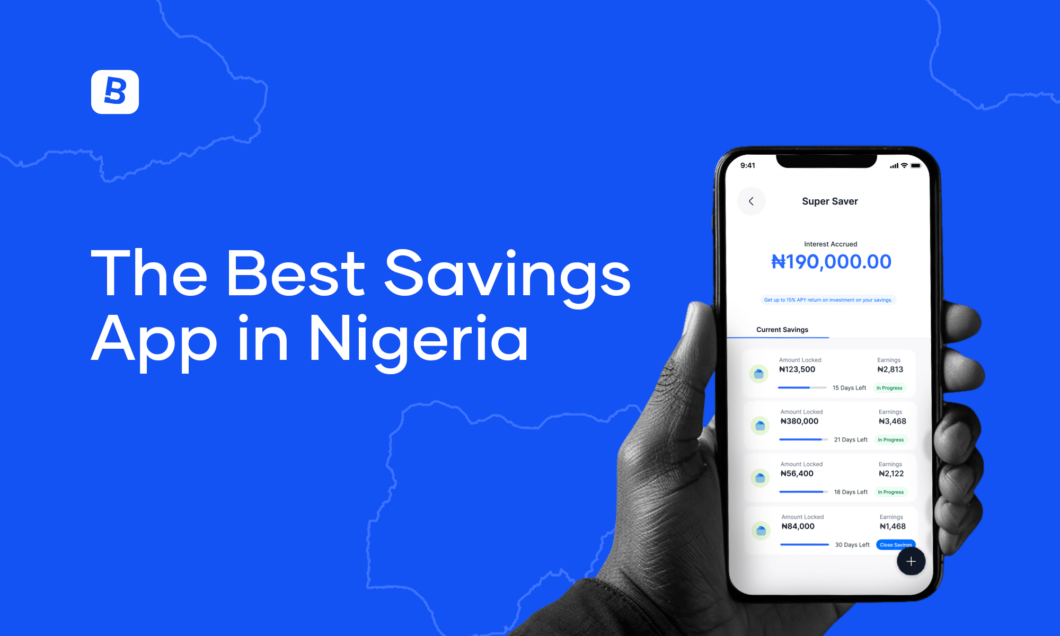

Although Bold is relatively newer than most of the savings apps we’ve shared above, it’s one of the best savings apps you can find anywhere.

When it comes to interest rates, platform fees, security, accessibility and customer care, Bold ticks all the boxes. Keep reading to learn how!

1. Bold Interest Rates

As we’ve mentioned, reasonable interest rates are among the most important factors to consider when choosing a savings app to keep your money with. Bold offers as much as 15% interest on your savings, making it ideal.

2. Bold Platform Fees

Bold offers the best deal when it comes to charges and fees. Not only does Bold not charge users any fees for things like bill payments, but when you pay bills you will get a 2% rebate. This means that 2% of the value of any utility bills you pay using the app will be paid back into your Bold wallet.

3. Bold Accessibility

Bold is super accessible. Unlike most other fintech apps, the sign-up process has been designed to be as seamless as possible, and it can be completed within a few seconds. Additionally, Bold has an easy-to-use interface that allows all users to pay bills or save with just a few clicks of a button.

4. Bold Security

Bold is licensed and regulated by the appropriate financial authorities, including the Central Bank of Nigeria. This means that you can trust that your savings are secure. Additionally, Bold uses the highest level of security protection to keep all user funds safe. With a 100% safety record so far, Bold is a savings app you can trust.

5. Bold Customer Care

With Bold, you’ll never have to worry about not being able to reach customer care when you need a bit of extra help. Bold has a team of customer care representatives available to respond to queries around the clock.

Is Bold the Best Savings App in Nigeria?

We’d have to say a strong yes but ultimately, you should try it for yourself. Using Bold is as easy as downloading it from the Google Play Store or IOS Store. Getting started is a seamless process. Simply download the app, get verified, and start saving!